Financial Literacy: Preparing Youth for Real-World Decisions

go.ncsu.edu/readext?1070994

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

Collapse ▲Financial literacy is an essential life skill, yet many adults still struggle with everyday budgeting and understanding how education, career, and lifestyle choices affect their financial well-being. That’s why it’s crucial to begin teaching financial literacy at a young age.

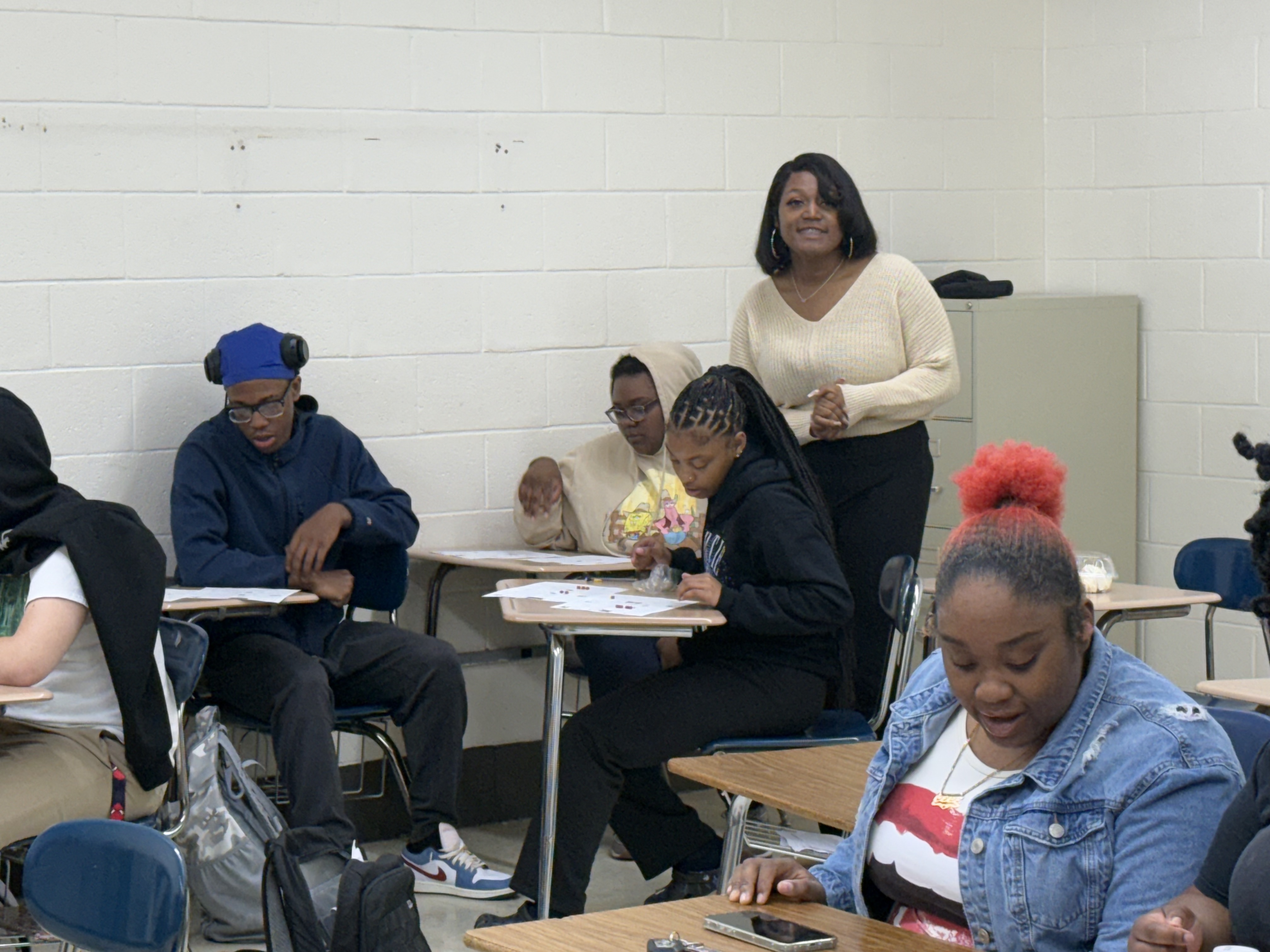

In celebration of Financial Literacy Month, 4-H Agent Toniqua and Digital Skills Agent Rebecca collaborated to deliver a five-week financial education program at Bertie Early College High School. Each week, students explored different aspects of personal finance in an engaging, hands-on way.

One of the key topics was how career and family choices directly impact monthly income and expenses. Each student was randomly assigned an occupation, number of children, and a monthly salary. From there, they navigated real-world financial scenarios, including deductions like taxes and Social Security, budgeting for savings and insurance, and learning how to safely manage their money through banking.

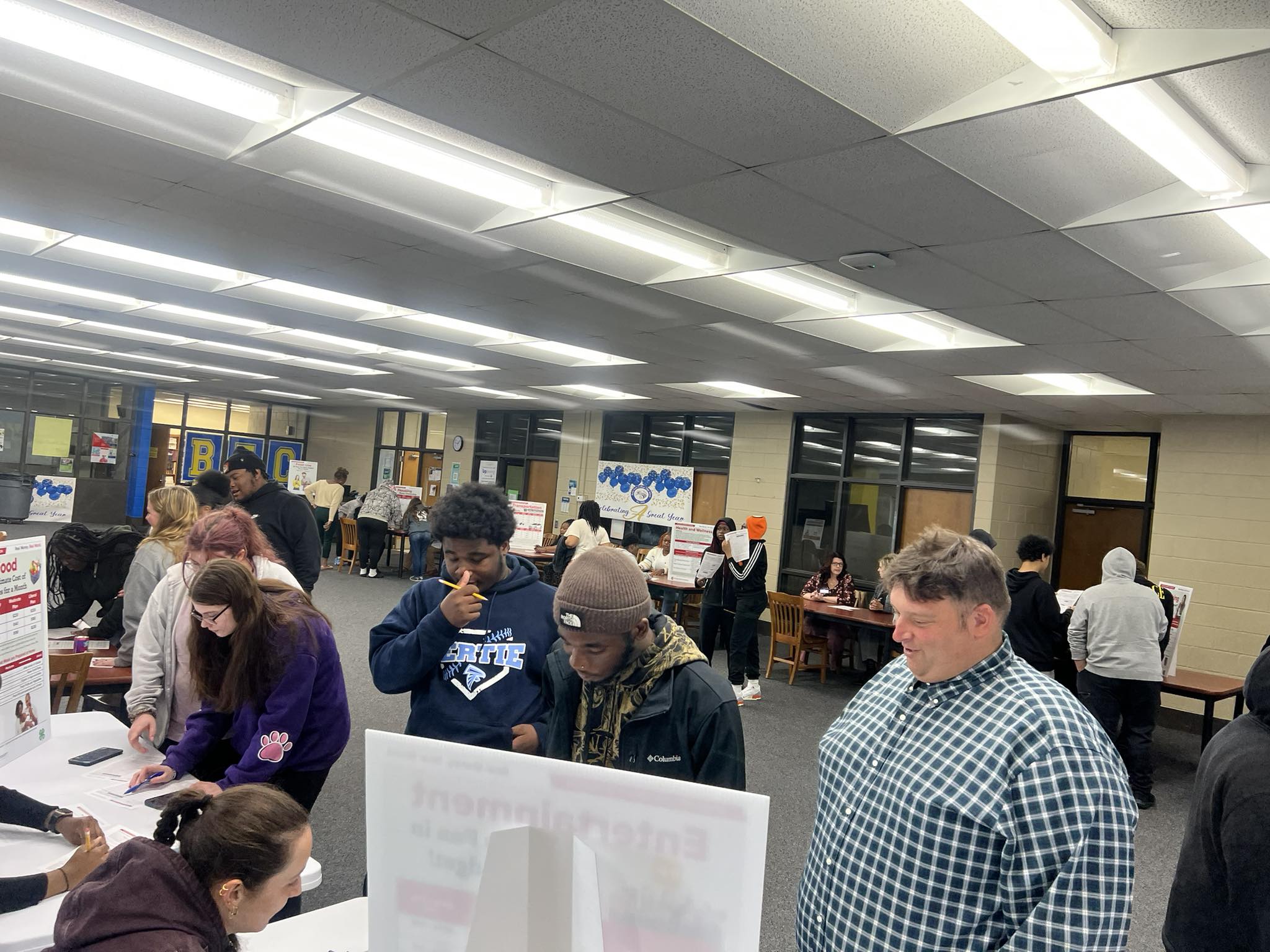

The program culminated in the Real Money, Real World simulation, where volunteers helped students make informed decisions across various life categories such as childcare, housing, insurance, student loans, clothing, and food. Students even encountered a “chance” booth—mimicking life’s unpredictability with surprise events like a flat tire or an unexpected windfall.

The program culminated in the Real Money, Real World simulation, where volunteers helped students make informed decisions across various life categories such as childcare, housing, insurance, student loans, clothing, and food. Students even encountered a “chance” booth—mimicking life’s unpredictability with surprise events like a flat tire or an unexpected windfall.

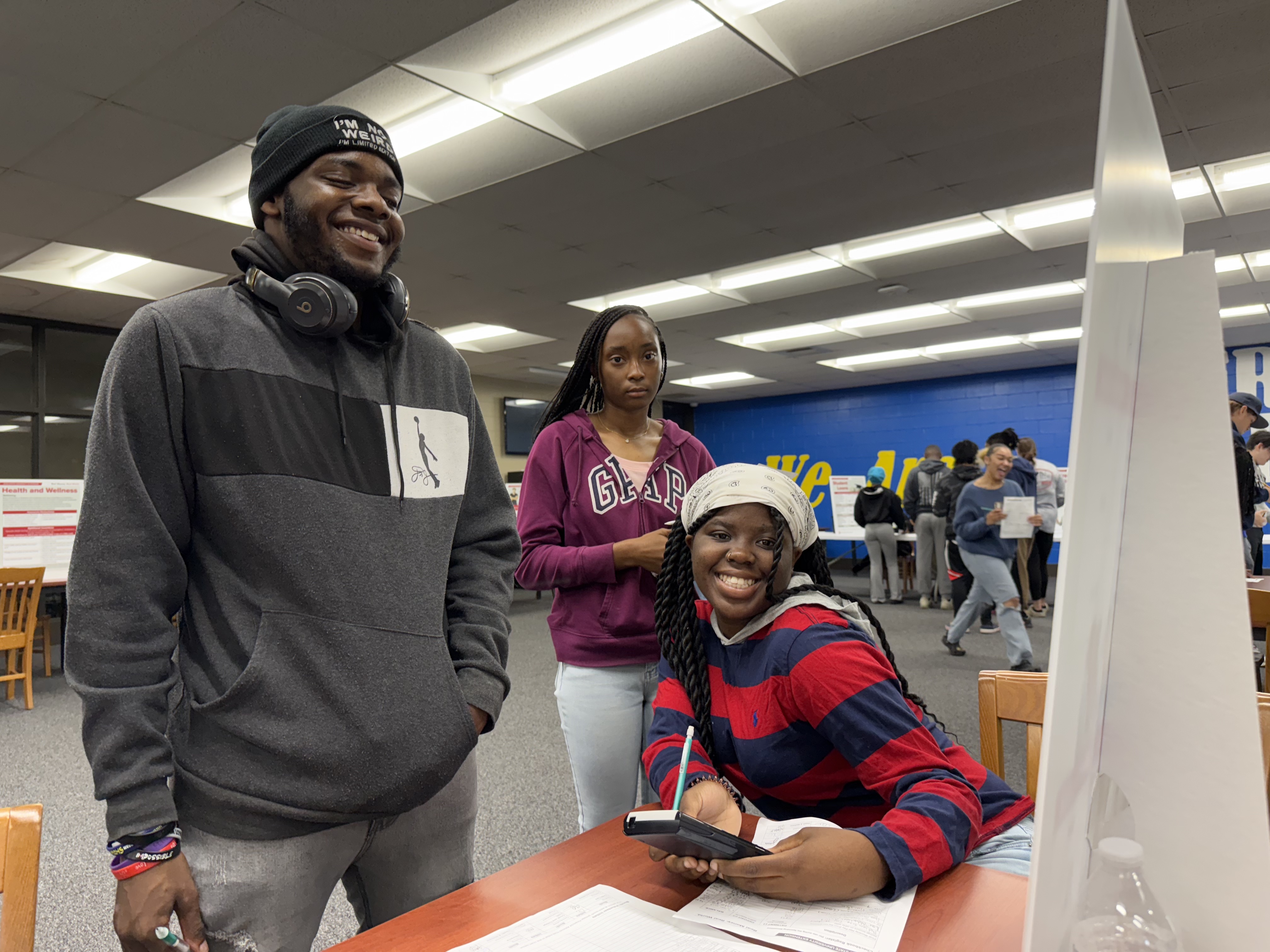

Feedback from students was insightful and encouraging. One student shared, “I would love to plan and save up for my first car now, so that I don’t have to worry about a high interest rate or car payment.” Another was surprised by the high costs of childcare and insurance. Many agreed that having children is a significant financial commitment.

While the class only lasted a little over a month, the impact was meaningful. We thoroughly enjoyed our time with this group and look forward to guiding the next class through this empowering journey.